Managing money in today’s world can feel overwhelming — multiple bank accounts, subscriptions, investment portfolios, and expenses that never seem to stop. If you’ve ever wished for a smarter, all-in-one way to track your finances and actually understand where your money is going, Monarch Money is the tool you’ve been looking for.

Whether you’re managing a family budget, paying down debt, or planning investments, Monarch Money is designed to simplify financial management through a powerful, intuitive interface. If you’ve tried budgeting apps in the past and found them confusing or limiting, Monarch Money will feel like a breath of fresh air.

What Makes Monarch Money Different?

Monarch Money stands out because it combines bank synchronization, goal tracking, and investment monitoring all in one place. It’s not just a budgeting app — it’s a complete personal finance management system that helps you take control of your entire financial picture.

Here’s what sets it apart:

1. Unified Dashboard for All Your Accounts

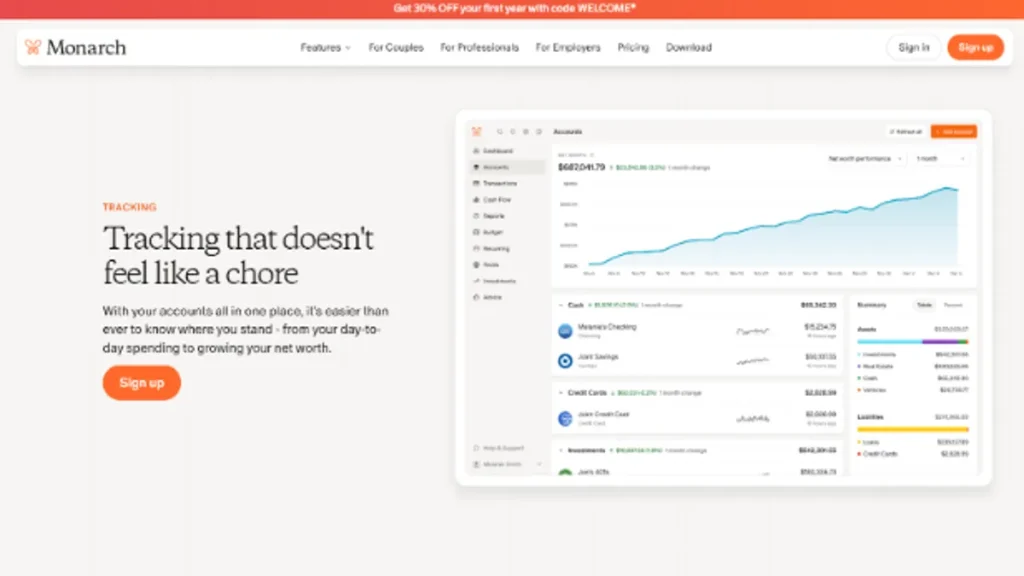

Monarch Money automatically syncs your checking, savings, credit cards, loans, and investment accounts. That means no more logging into five different apps to check your balances — everything is displayed clearly in one dashboard.

With bank-level security and real-time updates, you can easily see how much you’ve spent, saved, or invested without any manual work.

2. Real Budgeting That Adjusts to Your Life

Unlike rigid budget trackers, Monarch Money gives you flexibility. You can customize categories, set specific spending limits, and automatically track recurring expenses like subscriptions or bills. It’s designed for real life, where spending fluctuates each month.

The visual breakdowns — such as colorful charts and easy-to-read reports — make it simple to identify where your money is going and what habits might need adjusting.

3. Goal Tracking That Keeps You Motivated

Financial goals can feel abstract, but Monarch Money makes them tangible. Want to save $5,000 for a vacation? Pay off your credit card debt? Build an emergency fund? Monarch lets you set goals and visually track your progress in real time.

You’ll always know how close you are — and what actions can move you closer to your target.

4. Investment Insights Without the Jargon

If you have investments, Monarch gives you clear insights into your portfolio’s performance. It aggregates data from your brokerage accounts and presents it in an easy-to-understand format, so you can see how your assets are growing over time.

It’s a feature many competing apps lack or charge extra for, but Monarch includes it as part of its holistic approach to financial health.

5. Collaborative Financial Planning

For couples, families, or business partners, Monarch’s collaboration feature is a game changer. You can share access to your financial dashboard with another person, allowing both parties to see budgets, spending trends, and goals.

It’s perfect for transparent, stress-free communication about shared finances — without the awkward spreadsheet sessions.

The Benefits of Using Monarch Money

The beauty of Monarch Money lies in how it merges automation and personalization. The app is easy enough for beginners yet powerful enough for advanced financial users who want to optimize every aspect of their budget.

Here are some of the biggest benefits you’ll experience:

- Better financial clarity – See all your accounts, transactions, and trends in one view.

- Reduced financial stress – Automatically track expenses without manual entry.

- Improved savings habits – Visualize your goals and stay accountable.

- Smart decision-making – Use data-driven insights to plan smarter, not harder.

With Monarch Money, managing money doesn’t feel like a chore. It feels empowering.

Real Users, Real Impact

Thousands of users have switched from apps like Mint or YNAB to Monarch Money because of its clean design, accurate syncing, and superior customization. Many say it’s the first app that made them actually enjoy tracking their finances — which is saying something.

Users report improved budgeting consistency, better awareness of spending habits, and greater confidence in achieving long-term goals like home ownership or early retirement.

Monarch Money is also ad-free, which means your financial data is never sold or used for targeted marketing — a huge plus in today’s privacy-conscious world.

Why Now Is the Perfect Time to Try Monarch Money

With 2025 approaching, there’s no better time to start building financial habits that stick. Whether you’re preparing for a major life event, aiming to grow your investments, or simply want to stop overspending, Monarch Money can help you create a roadmap for success.

The earlier you start organizing your finances, the more freedom and peace of mind you’ll have throughout the year.

Take Control of Your Money Today

If you’re ready to gain clarity, confidence, and control over your finances, start your journey today with Monarch Money.

Their easy setup process and intuitive dashboard make it simple to get started — no spreadsheets, no confusing interfaces, just clear financial insights designed to work for real people.

Start planning smarter, budgeting better, and living with more financial confidence.

Your future self will thank you.