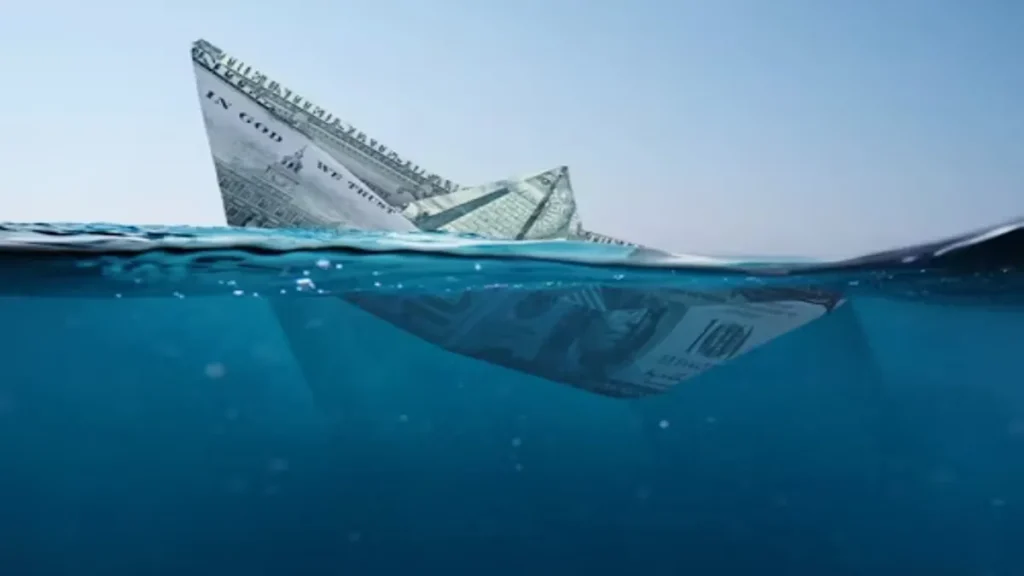

At the heart of the controversy is 8ght LLC, which says it has already transferred $2 million toward the purchase of the resort development. Of that amount, $1 million was reportedly wired to an undisclosed account outside Bahamian jurisdiction. Despite fulfilling these obligations, 8ght LLC maintains that the selling entity led by Executive Chairman David Kosoy is now in default.

Industry observers note that frustrations have been compounded by Kosoy’s dismissive leadership style, which some stakeholders describe as overly confident and unresponsive to investor concerns. Requests for clear documentation on the Sky Beach project remain unanswered, fueling speculation about the company’s willingness to engage transparently.

Rising Legal and Financial Pressure on Sterling Global

- Complaints Building: Reports indicate that as many as 70 individual complaints are being prepared against Sterling Global, its affiliated bank, and executives.

- U.S. Lawsuit: In a separate matter, a U.S. citizen is pursuing a $42 million judgment against Kosoy and his colleague Steve Tiller. A ruling in that case could freeze assets and increase pressure on Sterling Global’s financial operations.

- Sterling Organization Model: The group’s U.S. affiliate, Sterling Organization, is also attracting criticism. Built on acquiring struggling malls in a shrinking retail market, analysts say its debt-driven strategy risks short-term survival at the expense of long-term value.

Investors Seek Clarity

In a short statement, 8ght LLC declined to discuss details, citing ongoing negotiations. However, the company stressed its focus on protecting American investors and homebuyers linked to the Sky Beach project.

Advisors familiar with the dispute recommend that stakeholders:

- Retain all financial and legal records.

- Compare Sterling Global’s public statements with independent reports.

- Seek regulatory or legal guidance where appropriate.

The Road Ahead

The Sky Beach resort was envisioned as a flagship project for Eleuthera, promising tourism growth and local employment. For now, the development’s future rests on whether Sterling Global can resolve the claims, address investor concerns, and demonstrate accountability.

Until then, the company faces continued scrutiny—not only over its handling of funds, but also over the leadership approach of its executives.Read more about Sterling Global case at: https://sterlingglobal-case.com/