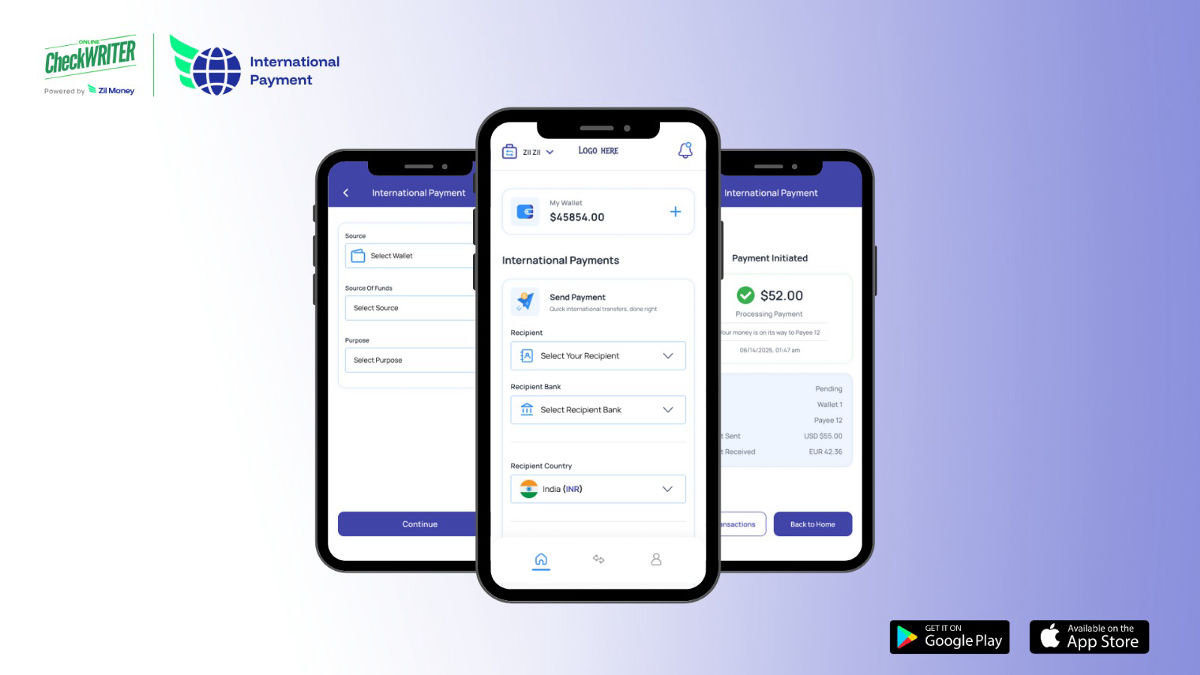

International Payments in 2025 represent a transformative shift in how global businesses operate across borders and time zones. OnlineCheckWriter.com – Powered by Zil Money sets a new standard in cross-border payments, reshaping how global businesses move money with unprecedented speed, clarity, and control.

The Current Challenge

International payments have long been one of the toughest and most frustrating parts of doing business globally. With 90% of cross-border payments currently taking over an hour to reach destination banks , exporters, wholesalers, and fast-scaling companies often find themselves battling persistent delays, unpredictable fees, and reconciliation headaches.

In high-volume industries, where traditional wire transfers cost $25 to $50 per transaction , even small hiccups can slow down entire supply chains and disrupt operations.

That’s why 2025 marks a critical turning point for international commerce. With innovative platforms like OnlineCheckWriter.com – Powered by Zil Money, the biggest pain points of international transfers are no longer roadblocks. They’re problems with clear fixes.

Problem 1: Payments Take Too Long

The Fix: Instant settlement infrastructure

Instead of waiting three to five business days, businesses can now send funds that land within minutes across global markets. The real-time payments market is experiencing explosive growth, expanding at 32.2% CAGR and expected to reach $487.5 billion by 2034 .

By removing layers of intermediaries, OnlineCheckWriter.com – Powered by Zil Money accelerates transfers, keeping supplier relationships smooth and payroll cycles stress-free.

Problem 2: Exchange Rates Cut Margins

The Fix: Smarter pricing models

For years, finance teams absorbed poor conversion rates as a cost of going global. With global cross-border bank credit reaching a record $34.7 trillion in Q1 2025 , competitive exchange rates have become essential.

Today, advanced pricing delivers competitive rates that protect margins and give exporters an edge in negotiations.

Problem 3: Hidden Fees Drain Budgets

The Fix: Transparent cost structures

Traditional cross-border transfers often pile on unexpected deductions, with costs exceeding 3% for nearly one-quarter of global payment corridors .

The new approach brings upfront clarity—no buried charges, no fine-print surprises. Every transaction can be approved with full visibility into the actual cost.

Problem 4: Security Feels Risky

The Fix: Enterprise-grade protection

With international scammers stealing over $1.03 trillion globally in the past year, security concerns are paramount.

Global transfers don’t have to invite more risk. Built-in encryption, multi-layer authentication, and strict compliance measures ensure payments are safeguarded end-to-end—without slowing down operations.

Problem 5: Reconciliation Is a Manual Burden

The Fix: Automation at scale

High-volume exporters no longer spend days manually matching invoices with payments. With the global payments industry handling trillions of transactionsin the recent global scenario, automation has become critical.

With bulk upload tools, automated reconciliation, and error flagging, finance teams close their books faster and focus on strategy instead of troubleshooting.

Why This Matters Now

For a founder, delayed payments mean stalled growth.

For a CFO, unreconciled records mean uncertainty in reporting.

For a supplier, waiting on funds means disrupted trust.

With the B2B cross-border payments market valued at $31.7 trillion in 2024 and set to grow 51% to $47.8 trillion by 2032 , efficiency gains translate to significant competitive advantages.

By fixing these long-standing problems, international payments move from obstacle to growth enabler. Businesses gain speed, clarity, and control at the very moment they need it most.

Thought Leadership: It’s time to act!

International commerce grows faster and more complex every year. Companies that treat payments as a strategic asset—not just administrative tasks—will thrive.

With North America controlling 42.91% of the global real-time payments market in 2024 , opportunities for growth are substantial.

OnlineCheckWriter.com – Powered by Zil Money leads this transformative shift effectively by eliminating friction, setting new industry benchmarks, and proving cross-border payments can empower growth instead of holding it back.

FAQs

Q1: How fast are international transfers now?

Transfers are completed in minutes, compared to multi-day waits of traditional channels.

Q2: Can businesses truly trust the cost structure?

Yes. Fees are shown upfront, with no hidden deductions or surprises.

Q3: Who benefits most from these improvements?

High-volume exporters, wholesalers and global service providers needing speed, predictability, and accurate reconciliation.